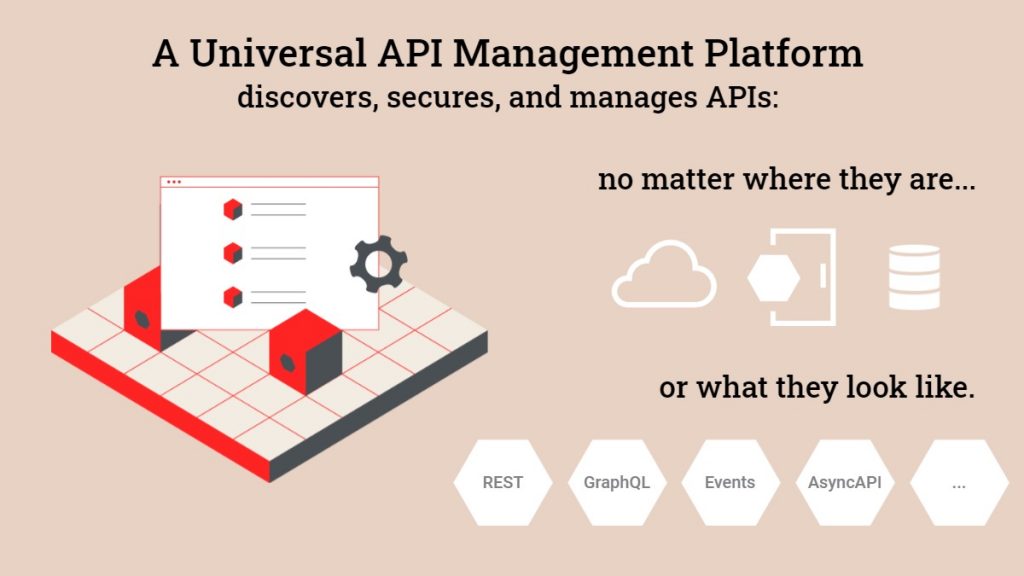

Universal API management is an emerging term that characterizes an expended set of capabilities beyond traditional API management. The first is the ability to extend API management to multiple vendors gateways, deployment patterns, and repositories (sometimes known as “federated API management”). The second is the ability to handle additional API patterns beyond basic SOAP and REST. This includes GraphQL, Events, Service Mesh, gRPC, and AsyncAPI to list a few.

Simply put, a truly universal API management platform is one that offers visibility and control over APIs wherever they are, and whatever form they make take.

In this article, you’ll learn more about who stands to benefit from these improved capabilities, how universal APIM works (and why an open approach is better), and the trends driving the need for universal API management.

How does universal API management work?

There are several approaches to accomplishing universal API management. The Axway Amplify Platform uses a lightweight, non-obtrusive agent to interface to all of your diverse API data planes (Axway, AWS, Azure, Apigee, Mulesoft …).

The agents do not sit in the data path (unlike the proxy approach used by some vendors which can drive up cost, latency, and deployment time) and allow common discovery, observability, and subscription.

A truly open approach to universal API management means multi-cloud, multi-protocol, and multi-gateway support, which also offers freedom from vendor lock-in.

What is driving the trend toward universal API management platforms?

API evangelist Kin Lane first talked about an API Economy nearly 13 years ago, but it’s still just as relevant – if not more – today. Every industry stands to benefit from the use of APIs that drive new forms of business; after all, APIs aren’t just for tech companies. But this proliferation and continuous evolution of API technology has ushered in a challenging new era of API complexity.

1. Sprawling business units building their own APIs

Developers need the flexibility and independence to innovate with the tools that work for them. But when business units are developing APIs independently of each other, you start to see silos that lead to fragmented CX, time-consuming management, and automation and standardization headaches.

It can also lead to significant duplication of resources. Two different teams might build the same API without knowing there is already one available that would serve their purposes. We’ve found that companies stand to save nearly $30K on average every time they reuse an API.

2. Multiple API gateways from multiple vendors

The average enterprise these days uses 3-4 different API management vendors – up to 5 in some cases. They often do this for good reason, wishing to differentiate between external vs. internal traffic, or on-premises vs. cloud deployment, or to manage different functionalities.

It becomes a problem when this complexity starts holding a company back.

Not having a universal view of the company’s assets can delay the launch of new digital projects and offerings or make it harder to onboard partners. And then, there are the questions of governance and security.

3. Unmanaged APIs roaming wild

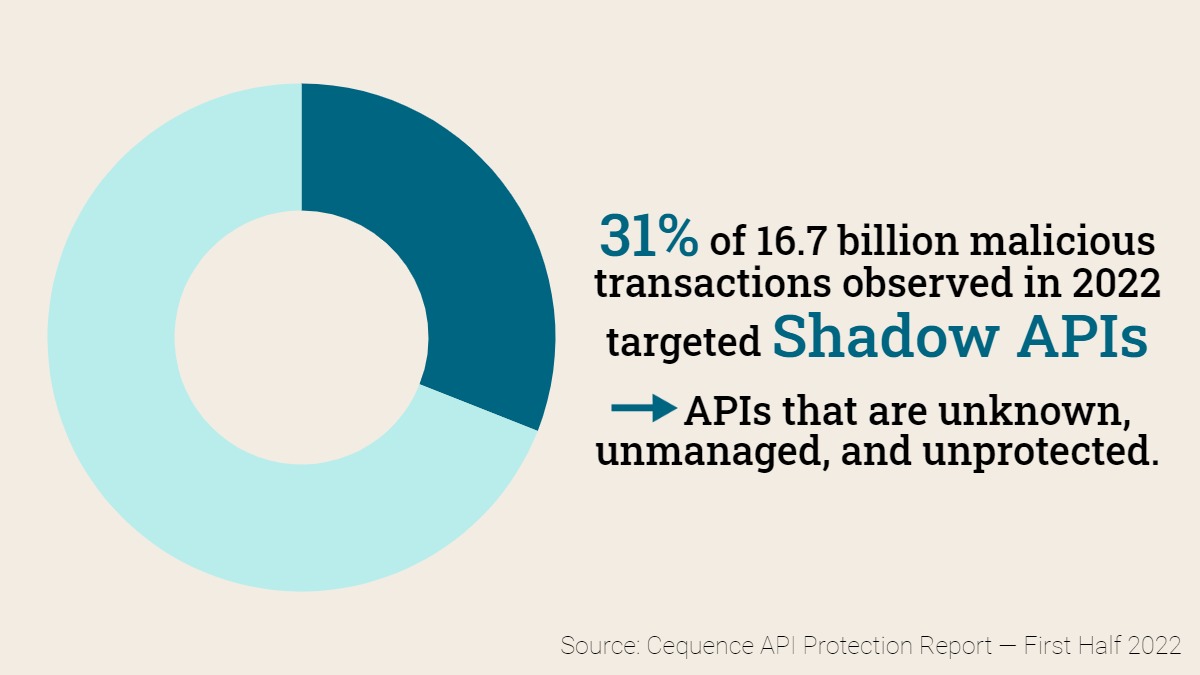

There’s no shortage of colorful terms for these, but whether you call them Zombie APIs or Shadow APIs, unmanaged APIs represent a risk to your organization. A 2022 analysis of more than 16.7 billion API transactions found that 31% of the malicious requests targeted unknown, unmanaged, or unprotected APIs.

And the number of API security incidents is growing fast. Almost 1/2 of IT leaders polled in a recent survey ranked security as the highest concern with regards to API growth, followed by API complexity. The two are closely related, as analysts predict that complexity will only grow as API proliferation continues.

Without a centralized view, it is harder to discover and secure APIs throughout an organization’s sprawling IT ecosystem. A unified platform allows for better security and compliance with industry standards.

What are the benefits of universal API management?

The problem that universal APIM addresses is the complexity of having API development happening all over your organization. Each team has their own tools, technology, and mandates. A universal API management platform, like Amplify, enables you to:

- Unify all your API assets and manage their lifecycle regardless of pattern, deployment, or platform

- Modernize without having to rip and replace existing API solutions

- Productize APIs for a more business-driven strategy

- Add new API patterns right alongside traditional REST and SOAP

- Monitor, manage, and govern all APIs from one pane of glass

- Drive adoption and monetization from a common API marketplace.

Who needs universal API management?

API platform teams

Master API complexity by operationalizing all your APIs. Get a complete operational view along with useage and performance metrics that increase service delivery at a reduced cost.

API consumers (innovation, digital, and application teams)

Decrease the time to value for APIs that drive digital business. Enable developers to speed delivery of initiatives by easily finding and using proven API products that are security validated, fully documented, and production ready.

Digital business leads

Increase the ROI on your APIs by promoting greater API adoption. Lower the barrier to entry and drive consumption of your digital business initiatives by promoting curated API products, not every single API that you have ever produced.

Watch the on-demand API Talks webinar to learn how to curate and package your APIs for business value.

Follow us on social